Traditionally, insurance underwriting relies heavily on static parameters such as asset age, location, and historical incident rates. However, the adoption of real-time online condition monitoring (OCM) offers a paradigm shift in how transformer risk is evaluated.

Introduction

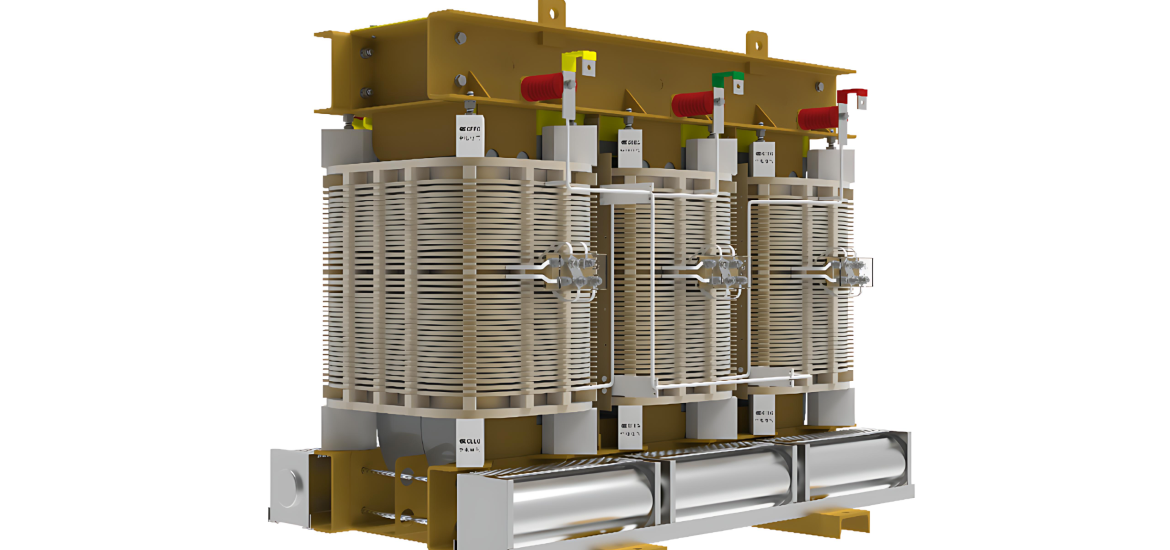

Insurance coverage for power transformers is an essential component of risk management in utility and industrial power systems. Premiums for these transformers can be substantial, particularly for aged or high-rated units. Traditionally, insurance underwriting relies heavily on static parameters such as asset age, location, and historical incident rates [1]. However, the adoption of real-time online condition monitoring (OCM) offers a paradigm shift in how transformer risk is evaluated.

This paper explores how OCM data can be integrated into insurer risk assessments, reducing uncertainty and enabling performance-based insurance models. The structure of the paper is as follows:

- Section 2 outlines the basic component of premium calculation and the drivers for premiums. It further establishes the linkage between OCM and insurance.

- Section 3 presents the calculations for a 30 MVA, 35-year-old transformer.

- Section 4 present engagement strategies, standards, and digital integration.

- Section 5 concludes with an outlook.

Base Calculation for Insurance Premium

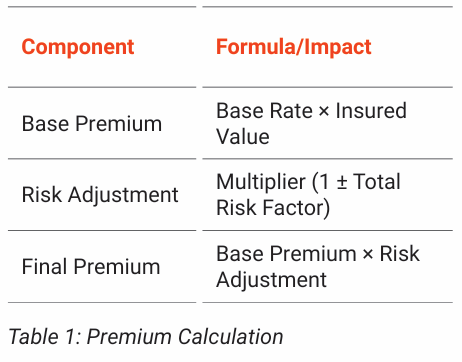

Calculating insurance premiums, especially for high-value assets like power transformers, involves several components. A simple computation formula for premium is shown below:

Where:

- Insured Value: Replacement cost of the transformer

- Base Rate: A rate per unit of the Insured Value

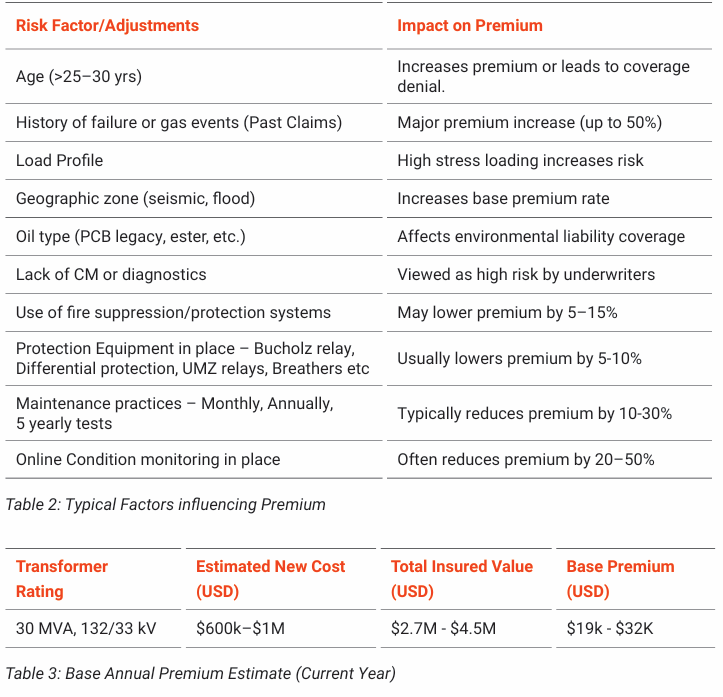

- Risk Factor: Multiplier based on operational, environmental, and transformer-specific risks including adjustments such as discounts or surcharges based on claims history, monitoring, maintenance, etc. Some common factors are included in Table 2.

The insured value of a transformer is the amount for which the asset is covered under an insurance policy. It typically includes:

- Replacement costs: new transformer cost, transportation to site, installation & commissioning, custom duties & tax (if imported), disposal of old unit, engineering/ project costs and added contingency (10–15%).

- Collateral damage costs: environmental liability, direct failure costs such as fire/explosions.

- Business interruption costs: loss of income, additional rental transformers if spare not available.

For a 30MVA, 132/33kV, an estimated approximate cost is listed in Table 3. These values will vary depending on – country of origin, design specifications, delivery lead times & manufacturer location etc. The total insured value is calculated considering replacement costs, collateral damage at 300% of new transformer costs. Business interruption cost is excluded in Table 3.

The base rate of insurance premiums for power transformers is usually calculated as a percentage of the insured value (sum insured). If the risk profile is standard, base rate should be 0.2-0.35%, with elevated risk around 0.4-0.65% while with high risk 0.7-1%. For a 35-year-old transformer, it could be perceived as high risk.

Modern transformer OCM systems encompasses a range of diagnostic tools. These OCM systems enable end users to implement predictive and risk-informed maintenance, a cornerstone of insurance reduction strategy.

Linking Condition

Monitoring with Insurance Premiums 57 57 Modern transformer OCM systems encompasses a range of diagnostic tools. These OCM systems enable end users to implement predictive and risk-informed maintenance, a cornerstone of insurance reduction strategy by:

- Risk Transparency and Quantification – Insurers respond positively to validated data. A continuously updated health index (HI) [2] or remaining life estimation (RLE) [3] provides a factual foundation for premium negotiation.

- Predictive Maintenance and Event Reduction – End users equipped with OCM systems observe significantly fewer catastrophic events. A CIGRE study has shown that transformer monitoring can reduce the risk of catastrophic failures by 50% [4].

- Usage-Based and Performance Based Premium Models – Progressive insurers offer pricing schemes based on transformer behaviour TRANSFORMER INSURANCE PREMIUMS AND CONDITION MONITORING rather than nominal rating and age, provided sufficient operational transparency is demonstrated.

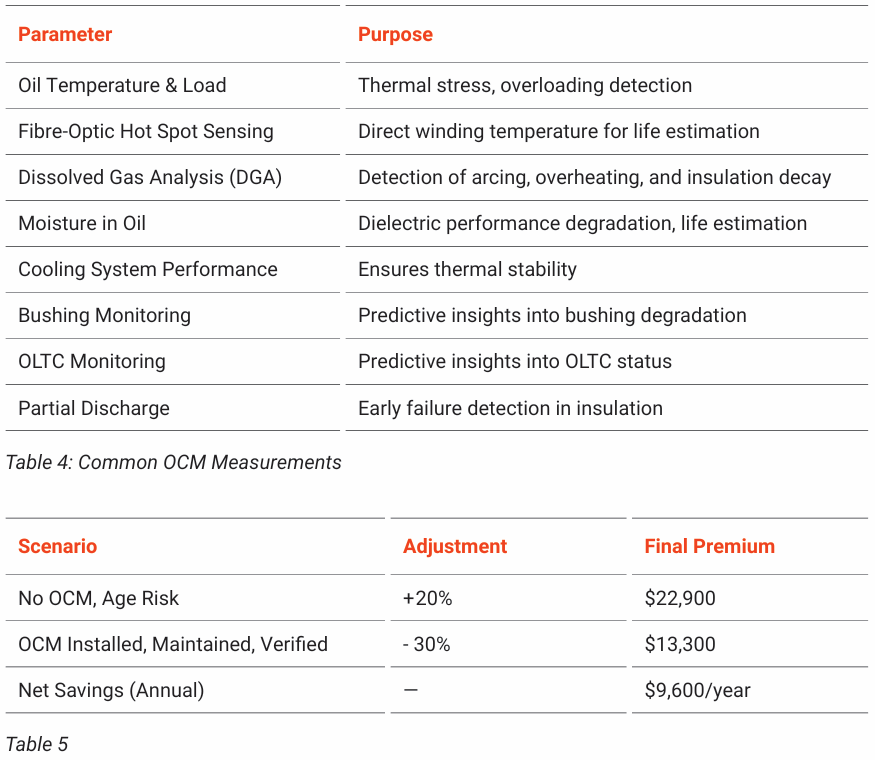

The key online parameters which enable detection of incipient faults and long-term degradation trends, creating a continuous health index are listed in Table 4.

These OCM shift the evaluation from age-based estimation to real-time condition assessment.

Quantifying Premium

Reduction Using the base premium = $19,000 from Table 3. Using a +20% adjustment for age without OCM while with OCM (20% age – 50% comprehensive monitoring) results in -30% adjustment. Comprehensive monitoring is defined in Section 3.1.

This net savings can be an additional benefit to the already quantified benefits explained in [5] such as:

- Reduced inspection and maintenance costs

- Reduced failure-related repair or replacement costs

- Improved real-time transformer loading capability

- Deferred upgrade capital costs due to load growth

- Deferred replacement capital costs due equipment age or condition

Apart from the above, there are other strategic benefits of OCM for insurance purposes:

- Documentation: Monitoring reports support underwriting reviews.

- Improved Risk Profile: Real-time data reduces perceived uncertainty.

- Negotiation Power: End users can present data to negotiate lower premiums.

- Failure Prevention: Early warnings reduce likelihood of claims.

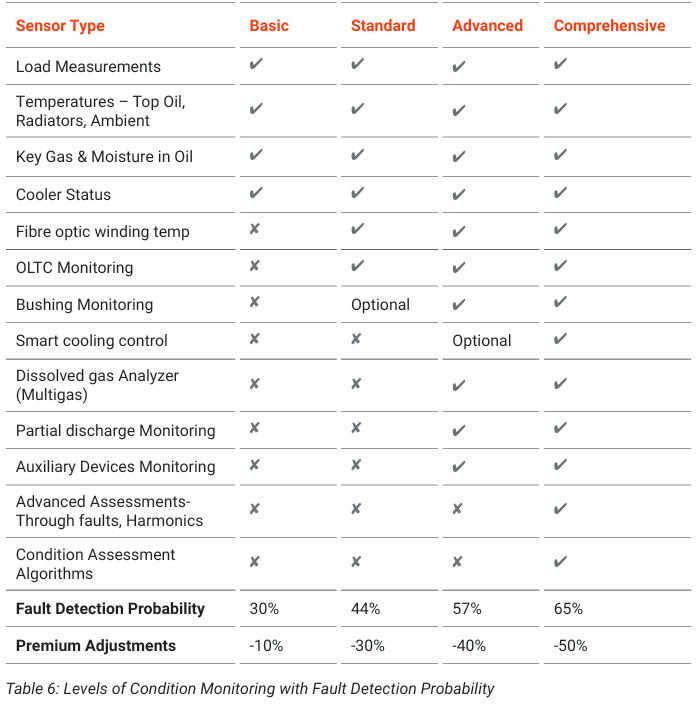

Quantifying Monitoring Levels for Premium Reduction

Transformer condition monitoring is typically implemented in three to four levels (Table 6), depending on the depth of diagnostics, data acquisition, and automation involved. These levels help end users select the right monitoring strategy based on asset criticality, budget, and risk exposure. The fault detection probability of these levels is calculated based on the method described in [6]. The corresponding premium reduction adjustments are also listed in Table 6.

Moving Ahead

Insurer Engagement Strategies

To translate condition monitoring data into premium reductions, end users must proactively engage with insurers. The following strategies can facilitate this transition:

Develop a Monitoring-to Insurance Framework

End users should implement a structured framework that links monitoring metrics to risk indicators recognized by insurers. This includes:

- Health Index Scoring (based CIGRÉ method [2])

- Real-time Fault Alert Systems

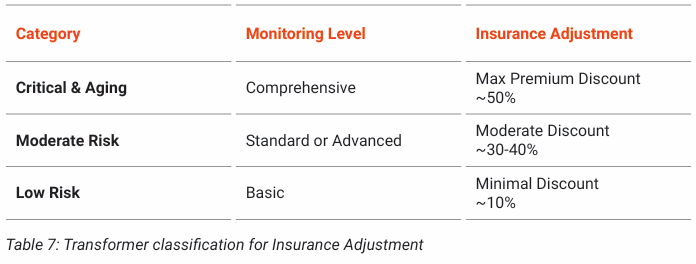

Risk-Based Asset Classification

End users should segment transformers by criticality and health condition as listed in Table 7.

Insurer Workshops

Most insurance companies, however, will want evidence of a maintenance regime to show that this expensive asset has had care and attention throughout its working life to minimise the risk of failure. If such reports are not available, there is a risk that the insurance company could seek to minimise its liability. Hence, there is a need to establish joint risk reviews with insurers to build trust and confidence in the data from OCM systems by:

- Demonstrate efficacy of predictive alerts.

- Review historical asset behaviour.

- Justify longer maintenance intervals based on OCM trends.

By following best practices in data transparency, standards compliance, and risk engagement, end users can position themselves as low-risk clients in the eyes of insurers.

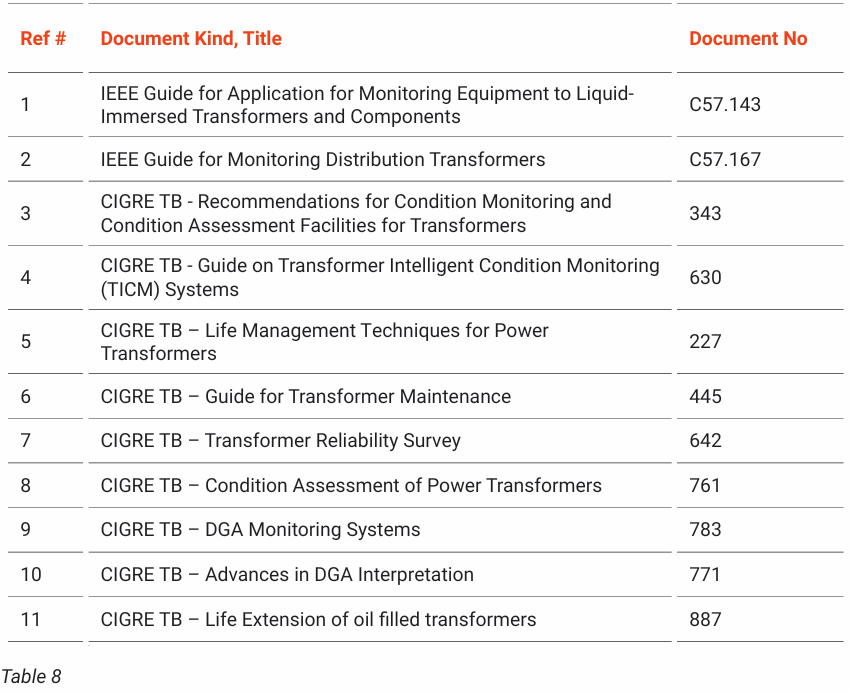

Standards & Certifications

Standards

global standards (IEC, IEEE or CIGRE), end users increase credibility and audit acceptance with insurers. Some examples of the many standards/ guides are presented in Table 8.

Transformer Assessment Index Certification

Independent certification of the transformer’s condition (by OEMs or third-party labs) can serve as a verified input to insurance pricing. Some insurers may accept:

- Transformer health certificates

- DGA diagnostic certifications

- Remaining Life Estimations (RLE)

Digital Integration

OCM systems when integrated into enterprise digital platforms, enhance their value in insurance negotiations. Monitoring systems integrated with platforms like DynamicMetrix from Dynamic Ratings enable centralized risk profiling, automated maintenance triggers and historical data-backed analytics.

For insurers to trust digital data, cybersecurity of OCM infrastructure is critical. Cyber-secure systems reassure insurers that data is reliable and tamper-proof. Compliance with ISO 27001 [7] is required.

Conclusion

OCM goes beyond maintenance: it is an asset risk management tool with direct financial implications. End users that strategically integrate monitoring with insurance negotiation can:

- Lower premiums

- Improve asset reliability

- Extend transformer life economically

By following best practices in data transparency, standards compliance, and risk engagement, end users can position themselves as low-risk clients in the eyes of insurers.

This paper demonstrates that financial returns through insurance optimization can be an additional benefit which will help to improve the IRR and payback period for OCM systems. Furthermore, the integration of OCM with international standards, digital asset management platforms, and emerging insurer frameworks (e.g., usage-based insurance) places early adopters at a distinct advantage. As insurers evolve toward dynamic, data-centric pricing models, end users equipped with robust OCM capabilities will not only reduce premiums but also shape how transformer risk is defined in the insurance sector.

Ultimately, OCM creates a new alignment between technical reliability and financial performance ensuring that well-maintained, healthy transformers are recognized and rewarded accordingly in the insurance marketplace.

References

[1] Risk Engineering Guideline – Power Transformers, HDI Global SE, HDI Risk Consulting, 2020.

[2] CIGRE Technical Brochure 761 – Condition assessment of power transformers, 2019.

[3] C. Krause et. Al, “The Condition of Solid Transformer Insulation at End-of-Life”, CIGRE Electra, N321, April 2022.

[4] CIGRE Technical Brochure 248 – Economics of transformer management, 2004.

[5] IEEE c57.143 – “IEEE Guide for Application for Monitoring Equipment to Liquid Immersed Transformers and Components”, 2012.

[6] S. Tenbohlen et.al, “Experienced-based Evaluation of Economic Benefits of On line Monitoring Systems for Power Transformers”, Paper 12-110, CIGRE Paris Session 2002.

[7] ISO/IEC 27001:2022, Information security, cybersecurity and privacy protection — Information security management systems — Requirements, Edition 3, 2022.

Dr. Bhaba P. Das is the Regional Manager (Asia Pacific) for Dynamic Ratings Austral ia, based in Wellington, New Zealand. He is a Senior Member of IEEE, Young Profes sional of IEC, Member CIGRE NZ A2 panel, Member of Engineering New Zealand. He has published 40+ technical articles in var ious peer reviewed international journals and magazines. He is a member of CIGRE working groups A2 D1.67 and CIGRE A2/ C3.70 as well part of the Standards Aus tralia EL008 Transformers Committee. He is also part of the advisory board for FAN project at University of Canterbury (NZ) and represents Dynamic Ratings at the Transformer Innovation Centre, University of Queensland, Australia. He has three pat ents in New Zealand & Australia related to condition monitoring. He has recieved the Hitachi Energy Global Transformer Excel lence Awards in 2020, 2021 and 2023 and New Zealand Young Engineer of the Year 2017 by Electricity Association of NZ. He has previously worked at Hitachi Energy Transformers Business Unit in Singapore & ETEL Transformers Ltd in Auckland, New Zealand. He completed his PhD in Elec trical Engineering from the University of Canterbury, New Zealand and Bachelors Degree in Electrical Engineering from Uni versity of Gauhati, Assam, India.

This article was originally published in the October 2025 issue of the Advanced Insulation Soulutions: Condition Monitoring for a Safer Grid magazine.

View Magazine