EXPERT OPINION: Experience from the Field

Foreword from the Editor:

One of the many things I love about Chris Kenney is that he “makes it real”. In this article, you can almost hear the conversations taking place between different professionals engaged in the insulating oils for transformers business. With this article Chris is challenging us to think about the impact that the “explosion of large power transformer and extra high voltage transformer installations across the whole of the North American landscape” has on this subject. In a unique way and in a practical way!

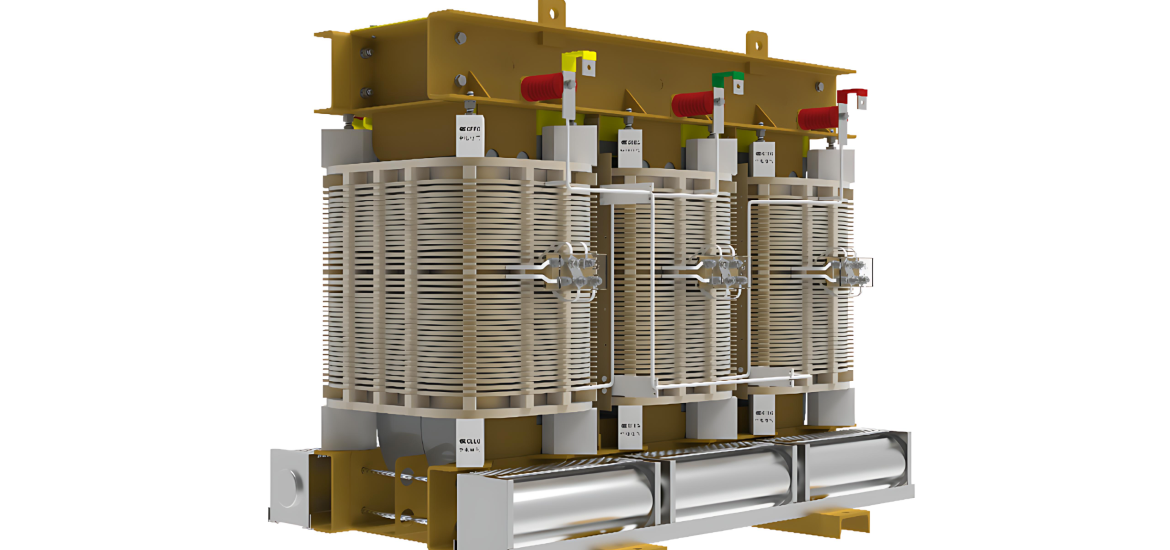

This is another great contribution from Chris and one that everyone involved can learn from and can apply. Well done Chris! Since the early 2000s there has been an explosion of LPT (large power transformer) and EHV (extra high voltage) transformer installations across the whole of the North American landscape. A 2011 report from an antidumping investigation by the United States International Trade Commission (USITC) defined LPTs as “large liquid dielectric power transformers having a top power handling capacity greater than or equal to 60,000 kVA (60 MVA), whether assembled or unassembled, complete or incomplete” [1].

The 2011 NERC Spare Equipment Data Task Force defines LPTs as follows [2]:

Transmission Transformers : The low voltage side is rated 100 kV or higher and the maximum nameplate rating is 100 MVA or higher.

Generation Step-up Transformers : The high voltage side is 100 kV or higher and the maximum nameplate rating is 75 MVA or higher. Starting in the mid-1970s, yearly installment of large, extra high voltage power transformers in the U.S. began to drop precipitously. In the United States, starting in the mid-1970s, yearly installment of LPTs and EHV transformers began to drop precipitously. This continued into the late 1990s with a record low point in 1994. This decrease in demand led to a decline in the domestic LPT manufacturing base in the U.S. and Canada. There were simply not enough orders to keep plants in North America busy making large power transformers.

As I discussed in my most recent article in Transformer Technology [3], the same sort of winnowing out of the refiners who produced transformer insulating oils was occurring among domestic LPT manufacturers. The transformer oil marketplace, as it had been in years past, seemed to have disappeared. Consequently, many of the refiners who had previously supplied the mineral oil marketplace were shutting down these lines of business. The subject relating to the globalization of the LPT manufacturing base with its resulting dislocations is a subject for another article. In 2002, the same demand for large power transformers, which seemed to evaporate starting in the mid-1970s, robustly returned. We are now in one of the highest-demand LPT markets in recent memory. All of this could be loosely categorized as “the modernization of the grid,” also an article for another day.

What does all this have to do with insulating oil field fill? The latest figures I could gather up as to current demand for mineral oil-based field fill would be based on a 2014 U.S. DOE Homeland Security study [4] which looked at the U.S. based LPT manufacturing base coupled to the modernization of the U.S. electrical grid. In 2015, over 500 large power transformers were imported into the U.S. market from overseas manufacturers. This number included only the units imported into the market, not the entire U.S. macro market for LPTs. Needless to say, the insulating oil field fill market is a serious market considering the insulating oil volume and distribution requirements. In 2002, the same demand for large power transformers which seemed to evaporate starting in the mid-1970s, robustly returned. What are the challenges facing the specialty refiners who attempt to fill this market demand? There are many. Insulating oil field fill may be one of the most difficult markets to satisfy on a consistent basis compared to other specialty oil delivery requirements. This is due to the very nature of the product application. I can think of no other specialty oil, when delivered, that undergoes the scrutiny insulating oils must pass. There are a number of tests that are performed right off the truck, namely dielectric, moisture and sometimes power factor testing.

An oil must pass these tests before the truck is accepted for delivery. Often these tests are performed in challenging environments that neither the operator nor the refiner has much control over. We are now in one of the highest-demand large power transformer markets in recent history. Some customers want the truck to be sampled; have the sample sent to an independent lab, and wait for the results while the truck and driver sit. In an era of a tight supply of line haul equipment and drivers, this is never a welcome request. Often, a 25-50 gallon dump from the truck tank manifold will disappear as an “off spec” oil, usually with regards to dielectic. Often a truck will return to the refinery having been declared “off spec” and will test “on spec” by the refinery lab.

Some large LPT OEMs are chronic in their placing an order and then calling the truck back after the truck has left the terminal or refinery. Others place orders which necessitate the procuring of a truck and trailer and then abruptly cancel because of technical issues with the transformer setup at the site.

These are just a few in a long list of reasons that lead to loads being refused, called home or deferred to a later date. They all cause frustration and cost money on both sides of the transaction. Some are the fault of the OEM; some are the fault of the refiner marketer, and some are the fault of the truck carrier. By far the most irritating is when the OEM customer’s customer inserts what I call “rouge” specs on the oil delivery. This often manifests itself in asking for PPM water content far below the standard ASTM 3487 industry standard for moisture in product.

Insulating oil field fill may be one of the most difficult markets to satisfy on a consistent basis due to the very nature of the product application. Lastly, in order to lessen delivery risks, proper logistical support must be provided by a remote terminal infrastructure. Shipping these products over long distances is expensive, ties up trucks for an unacceptably long periods of time, and heightens the possibility of late shipments – and off-spec product. Many of these issues are communication issues that can be solved by a quality customer service department, preferably one with dedicated insulating oil customer service representatives.

Refiners must also ensure they are aligned with trucking companies that have at least some trailers dedicated to only carrying transformer oils. Construction site crews must provide trained oil test operators, testing to ASTM standards on both method and containers. In short, everyone must do their job, take quality seriously and commit at every level to follow best practices when handling the product.

To oil suppliers who understand the risks and rewards of engaging in this particular piece of the insulating oil supply chain to the LPT market, there will be an adequate financial return, ratable business, and growing revenue. To the OEM manufacturer and utility, there will be timely deliveries, lower construction setup costs, and a quality product with which to energize their new transformer.

References

[1] U.S. International Trade Commission (USITC), “Large Power Transformers from Korea,” Preliminary Investigation No. 731-TA-1189, September 2011, available at http://www.usitc.gov/publications/701_731/Pub4256.pdf

[2] The North American Electric Reliability Corporation, “Special Report: Spare Equipment Database System,” October 2011, available at http://www.nerc.com/docs/pc/sedtf/SEDTF_Special_Report_October_2011.pdf

[3] Chris Kenney, “Transformer Oils Supply Chain in North America: Short and Long Term,” Transformer Technology, Issue 9, Nov/Dec 2020, pp 64-67, available at https://www.powersystems.technology/community-hub/technical-articles/1873-insulating-oil-field-fill-challenges-and-remedies-digital-article-transformer-technology.html

[4] U.S. Department of Energy, “Large Power Transformers and the U.S. Electric Grid,” April 2014, available at https://www.energy.gov/sites/prod/files/2014/04/f15/LPTStudyUpdate-040914.pdf

Chris Kenney

Chris Kenney spent the majority of his time in the refining industry in the sales and marketing of specialty hydrocarbon fluids, more specifically in transformer oil sales. Chris has worked in sales and sales management with Ergon Refining, Cross Oil, Petro Canada and most recently, Calumet Specialty Products. In all these assignments, he was at the forefront in business development roles dedicated to developing net new transformer oil market share. Chris is an expert in the technical aspects of both naphthenic and paraffinic transformer oils and has established worldwide contacts in the power transformer industry and US utility industry.

Chris holds a Bachelor of Arts from St. Joseph’s University, and currently resides in Acworth, GA with his wife Karen. Chris is available for either full, or part-time consultation arrangements regarding the sale and marketing of transformer oils. Share this article

This article was originally published in the March 2021 issue of the Impact of the Next Generation of Design magazine.

View Magazine