Overview of Tariff Impacts

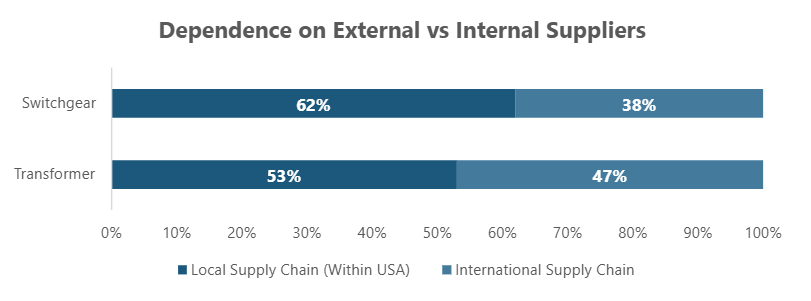

When the latest round of tariffs was announced, it seemed like every call I had that week began the same way: “Have you seen the new tariff list?” The mood across the industry was tense, and for good reason. Few sectors feel the ripple effects of trade policy as sharply as the power sector. Whether it’s transformers, switchgear, or conductors, the U.S. relies heavily on imports from countries such as India, China, Mexico, and South Korea. These regions have long been central to the electrical equipment supply chain. Even for equipment assembled domestically, many of the core raw materials, copper, aluminum, and steel, trace their origins back to global suppliers in Chile, Canada, and India. The result is a uniquely exposed industry, where tariffs not only raise costs but also reshape sourcing strategies, delay projects, and challenge the very economics of the energy transition.

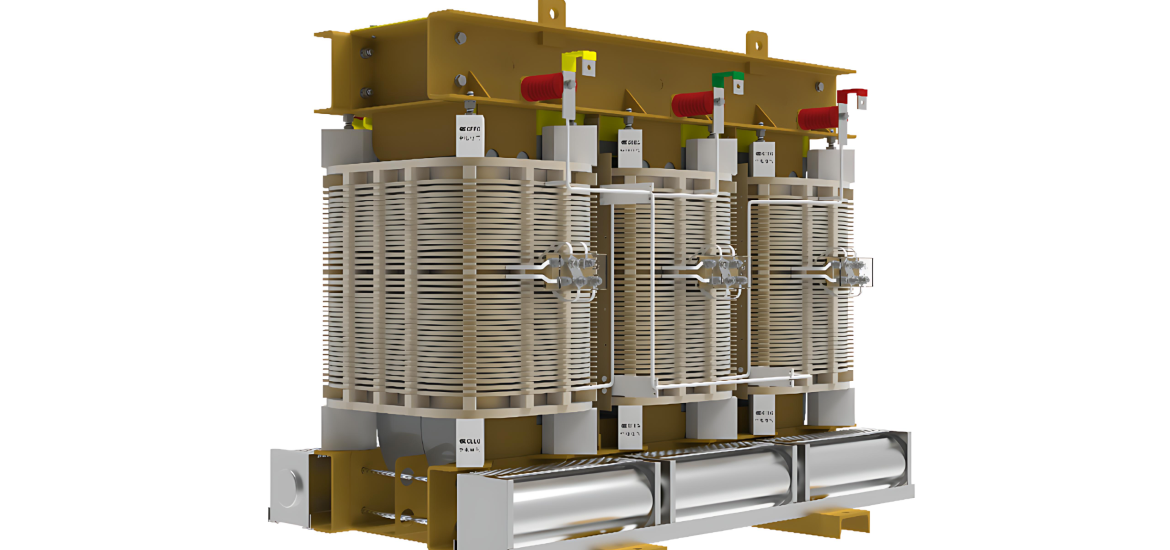

The interconnected nature of the global supply chain for electrical equipment makes the impact of tariffs especially pronounced. Power transformers serve as a clear example of this complexity. While the U.S. remains a key market for large power transformers, the majority of critical components are sourced internationally.

Core materials, such as grain-oriented steel, are primarily imported from Japan by suppliers like JFE Steel or Nippon. Copper conductors are sourced from Canada, and insulation oils are obtained from European suppliers. Even when final assembly occurs within U.S. facilities, the dependency on these imported components remains significant.

Components mostly under Tariff Influence

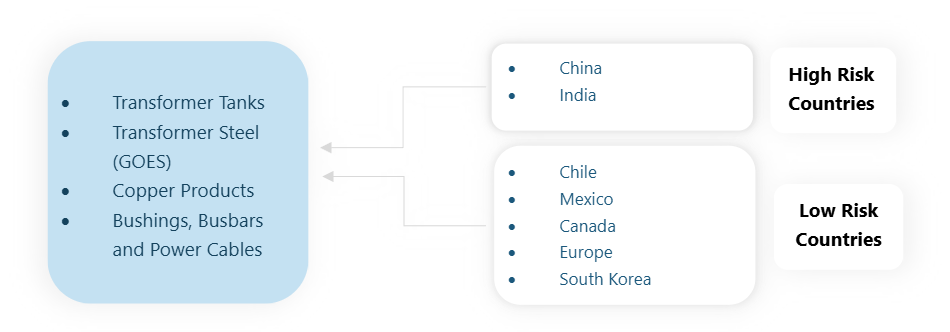

With new U.S. tariffs on imported steel, transformer-grade GOES (Grain Oriented Electrical Steel) remains one of the most affected components, as nearly 80–85% of U.S. demand is still met through imports from Japan, South Korea, and Canada. While Canada enjoys relative exemption under the USMCA, tariffs on Asian imports have driven up core material costs by 20–25%, significantly impacting the economics and procurement timelines of transformer manufacturing.

The recently imposed 50% tariff under Section 232 on copper and copper-containing semi-finished products has significantly increased the cost of windings, a vital input for transformers, switchgear, and cables. The U.S. sources a substantial portion of copper materials from Chile, Mexico, and Canada, with Canada again enjoying relative exemption. For imports from Chile and Mexico, tariff-linked cost inflation has been observed, resulting in an overall equipment price increase of 6–8%, as copper accounts for roughly 25–30% of the total transformer cost.

Transformer tanks, the most steel intensive part of the equipment, have become a significant bottleneck in the supply chain. Nearly 60% of the tank supply is imported from India, Spain, Mexico, Turkey, and China, all of which are now subject to a 50% steel tariff. These tariffs have made tanks one of the highest risk components across the power equipment value chain.

Implications for the other sectors

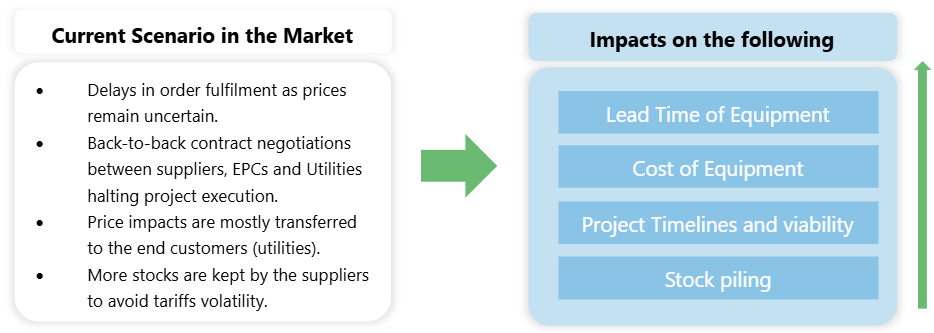

- The ripple effects of tariffs on the power sector go far beyond increased costs for transformers and switchgear; they reach deep into utility business models, project economics, and the pace of energy transitions. At the raw-materials level, tariffs on steel, aluminum, and copper (or their semi-finished derivatives) raise the base cost of nearly every capital-intensive power asset. Utilities routinely source structural steel for towers and poles, aluminum for conductors, and copper for wires, cladding, and connectors, all of which now carry elevated import risk. In many transmission projects, material costs already account for 20–30% of the total capital outlay; therefore, when tariffs inflate those inputs, the result is not just margin pressure but real trade-offs in whether projects remain viable.

- Importing finished products has become increasingly expensive for renewable sectors, particularly solar and wind, where imported components such as inverters, transformers, and switchgear account for nearly 50–60% of total equipment costs. Following recent tariff hikes, project costs for utility-scale solar installations have reportedly increased by 8–12%, extending payback periods by up to two years on average

- In the data center and AI infrastructure space, a rapidly growing load segment for utilities tariffs amplifies cost shocks across multiple layers. Data center construction and equipment procurement require steel, aluminum, cabling, power distribution units, switches, cooling systems, and transformer capacity, all of which are increasingly vulnerable to shifts in trade policy.

- More broadly, tariffs introduce both uncertainty and timing risk into utility capital planning. When long lived assets such as substations or grid-modernization projects are budgeted years in advance, volatility in input prices undermines cost forecasting and investment reliability. The recent 50% tariff imposed under Section 232 on steel and copper imports has already led to noticeable upward pressure on material costs, pushing several utility and EPC f irms to reassess procurement timelines and project feasibility.

Strategic Approach for Manufacturers:

- Funding from Federal Authorities to establish local presence: For manufacturers, one immediate strategy is to localize production through partnerships or joint ventures with established U.S. players. Establishing assembly operations, even if not on a full scale manufacturing basis, can reduce tariff exposure while demonstrating a commitment to the domestic market. Several U.S. states are currently offering manufacturing incentive packages and grants to attract industrial investment in energy infrastructure and electrification supply chains, opportunities that foreign OEMs can leverage to offset setup costs.

The ripple effects of tariffs on the power sector go far beyond increased costs for trans-formers and switchgear; they reach deep into utility business models, project economics, and the pace of energy transitions.

Establishing assembly operations, even if not on a full-scale manufacturing basis, can reduce tariff exposure while demonstrating a commitment to the domestic market.

- Alternative Supply-chain methods: Sourcing components from low-tariff regions such as the European Union, Vietnam, Malaysia, or the United Kingdom can help manufacturers build a more sustainable and cost efficient supply chain. Diversifying procurement toward these regions mitigates exposure to tariff-related cost pressures while maintaining production continuity. For instance, despite facing reciprocal tariffs of around 15%, Germany remains a dependable and strategically viable sourcing hub for specialized electrical components, thanks to its strong logistics network, favorable geographic location, and stable geo-political conditions. In contrast, India and China remain vulnerable due to ongoing trade tensions with the United States, which continue to disrupt supply chain stability and add uncertainty to long-term sourcing strategies.

- OEM–Supplier Synergy Framework: OEMs can strengthen relationships with their component suppliers by shifting from transactional interactions to long-term, collabo rative partnerships centered on innovation, quality, and delivery. This can be achieved through joint planning and forecasting, along with developing supply chain models that enhance visibility for suppliers into the OEM’s projected demand and confirmed orders. Such transparency enables components suppliers to proactively secure raw materials and maintain dedicated inventory, ultimately reducing lead times and optimizing costs for both parties.

What can utilities do in this current tariff scenario?

- Standardization across the network: Utilities should adopt a standardization approach across their network infrastructure, particularly in substation design and equipment specifications, to enable consistent procurement and deployment practices. By standardizing transformer and switchgear types, utilities can benefit from bulk purchasing, simplified maintenance, and faster installation timelines. This approach also helps mitigate the risks of price inflation and production bottlenecks, as standardized demand allows manufacturers to optimize their production schedules. Industry estimates suggest that such standardization can reduce overall cost pressures by up to 30%, driven by economies of scale and more streamlined coordination between utilities and equipment suppliers.

- Better Forecast of Demand: Utilities must integrate and upgrade digital technologies across their networks to actively monitor and forecast consumer demand. This digital transformation will enable them to prioritize critical projects and gain clearer visibility into future capital requirements. By leveraging data-driven insights, utilities can anticipate upcoming demand for transmission and distribution (T&D) equipment and enhance coordination with EPC partners and manufacturers, ensuring timely and efficient project execution.

- Long-Term Contracting for Price Stability and Supply Visibility: Utilities can foster sustainable partnerships with OEMs by establishing long term contracts that ensure price stability and supply continuity. Rather than relying on short term price adjustments, multi year agreements with special price clauses can mitigate tariff driven cost volatility and provide predictability in procurement and budgeting. These contracts also give OEMs clearer visibility into future demand, enabling better production planning and potential localization of manufacturing within the U.S. Additionally, utilities may explore co-investment opportunities with key manufac turers to secure critical equipment supply, strengthen production capacity, and reinforce long-term supply chain resilience.

Way Forward

The current U.S. tariffs have had a significant impact on the power sector, which is otherwise showing strong growth driven by the surge in AI-related data center demand and renewable energy targets, accelerating grid expansion and modernization. In this environment, it is crucial for the three major stakeholders OEMs, component suppliers, and utilities to collaborate closely to navigate ongoing trade tensions and sustain growth.

While establishing a local manufacturing base is time-intensive, it is crucial for long-term business sustainability and tariff resilience. OEMs and their supply chains must progressively localize operations within the U.S. to reduce import exposure and strengthen supply security. Achieving this requires coordinated government support through funding incentives, tax credits, and workforce development programs such as the CHIPS Act and Manufacturing Extension Partnerships that ease setup costs and address skill shortages. Public-private collaboration can further accelerate localization by aligning technical education and manufacturing needs. Without such concerted action, the demand-supply gap in the U.S. power infrastructure sector will continue to widen, increasing costs and supply risks.

About PTR

With over a decade of experience in the Power Grid and New Energy sectors, PTR Inc. has evolved from a core market research firm into a comprehensive Strategic Growth Partner, empowering clients’ transitions and growth in the energy landscape and E-mobility, particularly within the electrical infrastructure manufacturing space.

Contact: sales@ptr.inc

Hassan Zaheer is the Managing Partner & COO at PTR Inc. based in Abu Dhabi, UAE. With more than a decade of experience in the energy transition space, Hassan advis es various Fortune-500 and blue-chip clients in the electrical infrastructure sector to sus tainably grow their businesses, both through custom consulting work, marketing support services and tailored research reports by PTR, helping their executive management and boards make data driven decisions. Has san is also a Member of Advisory Board for CWIEME Berlin and MENA EV Show, part of the Executive Editorial Board of APC Media and an advisor to the educational non-profit Better Humans Academy. Hassan has a tech background with a Masters in Power Engi neering from the Technical University of Mu nich (TUM) and a BS in Electrical Engineering from the Lahore University of Management Sciences (LUMS). Additionally, he is also an Alumni of Center for Digital Technology & Management (CDTM).

Saad Habib is a skilled analyst and project manager who specializes in market research and project management. He is presently employed by PTR. Inc as an Analyst-II, work ing closely with clients who are Fortune 500 organizations and gives them market entry strategies and insights on the evolution of the global power grid market.

This article was originally published in the October 2025 issue of the Advanced Insulation Soulutions: Condition Monitoring for a Safer Grid magazine.

View Magazine